Welcome subscribers,

In our latest reader survey, many of you asked for a more regular newsletter. We heard you! After some preparation and creative thinking, we’re making it happen with a new weekly format.

Here’s what we cover today:

✅ Market overview: 2024 trends in life sciences real estate

✅ Expert insights: Jessica Hardman on market dynamics

✅ Big deals: €109 billion investment in French data centres

🔒 New developments: London’s Knowledge Quarter

🔒 Animal health: bees, buildings and biotech

(🔒 items are for paying members only)

Read more below for all the details. Our usual deep dive analysis and list of deals will return on 20 February.

— Stephen Ryan (connect with me on LinkedIn)

Review of 2024: strong demand drives growth in European life sciences real estate

The European life sciences real estate market remained highly active in 2024, recording 383 transactions and €21 billion in total investment across 17 countries. Deals spanned 5.5 million sq m of space, reflecting strong demand from both institutional investors and life sciences companies expanding their operations.

The UK saw the highest number of deals (158), followed by Germany (71). Ireland, the Netherlands, Spain, and France each recorded between 20 and 40 deals. Together, the UK and Germany accounted for 60 per cent of all activity.

New developments drove market activity, accounting for more than half of all deals. Pension funds and specialist developers such as Kadans Science Partner backed speculative developments, while pharmaceutical firms like Novo Nordisk and Eli Lilly focused on purpose-built facilities. Leases made up 75 deals, with another 79 involving asset sales. The remaining 31 transactions covered conversions and financing arrangements.

The average lease length was 13.5 years and the most popular lease term was 10 years.

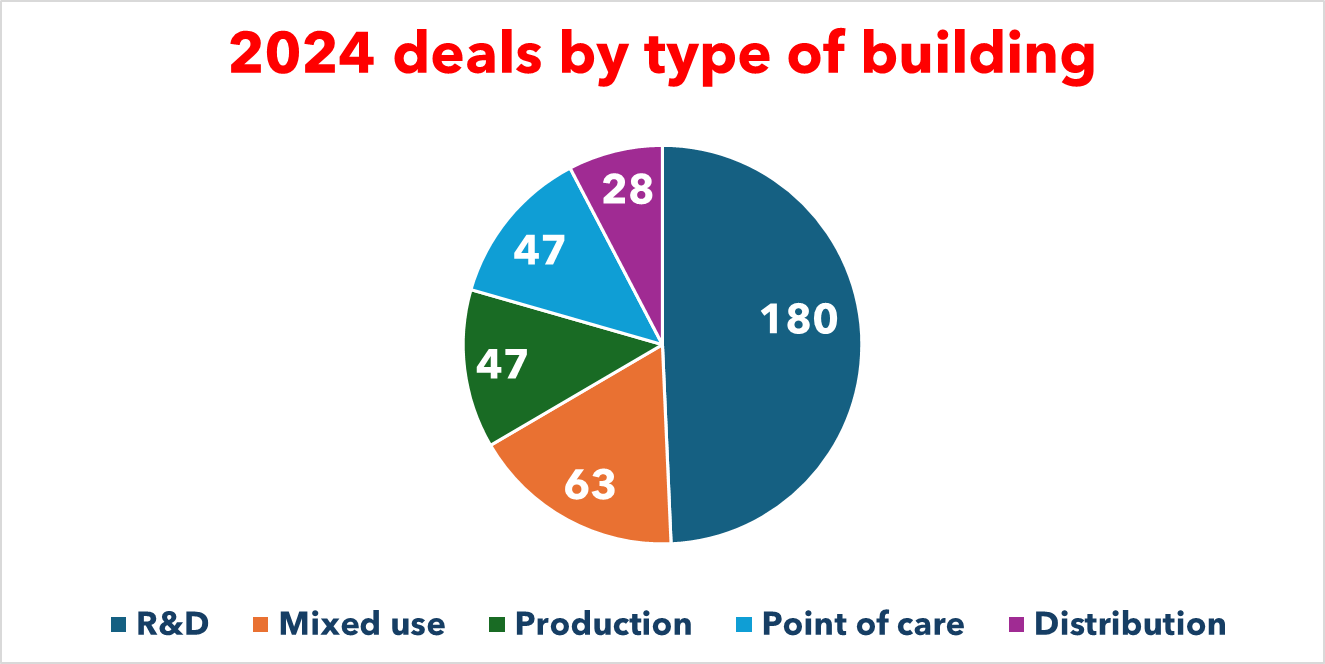

Type of building involved in each deal

- R&D facilities: 180 deals (highest investment)

- Mixed-use projects: 63 transactions

- Production facilities and point of care: 47 deals each

- Distribution centres: 28 deals

- Offices: remaining transactions

The size and value of transactions varied widely. Some assets sold for less than €5 million, while others exceeded €500 million. R&D facilities typically ranged from 1,000 to 20,000 sq m, whereas distribution centres tended to be much larger.

Key logistics deals included:

- Germany: 49,000 sq m facility

- Netherlands: 38,500 sq m site

- Spain: 110,000 sq m project

Several dealmakers featured in three or more deals. These include British Land, Foncière des Praticiens, Kadans Science Partner, Life Science REIT, Mission Street, Stoneshield Capital and VALUES Real Estate.

To get a sense of how investors are approaching these trends, read the comment from industry expert Jessica Hardman below.

📌 983 records – transactions logged across Europe

📌 23 countries – coverage of key life sciences hubs

📌 €56 billion – total investment tracked

📌 22 million sq m – space transacted

It's also easy to sort, filter and search through it. Access the data

Industry voices

Former DWS UK chief executive Jessica Hardman shared insights on asset pricing across sectors. Now co-founder of Aboria Capital, Hardman observed that while some investors might be waiting for distressed opportunities, these haven't materialised in life sciences - or indeed in logistics, data centres, or the living sector. "If you want to find some distress, you'll see it in secondary offices," she noted, highlighting the relative strength of life sciences real estate even in challenging market conditions.

“We need to put across to investors not to wait for the distressed deal. It didn’t really come in any of the sectors they want to be in – which are logistics, data centres, life sciences, and the living sector.”

AI data centres in France

Looking beyond life sciences but sticking with operational real estate, another sector attracting major capital inflows is AI-driven data centres.

France has announced 35 "ready-to-use" sites for AI data centres (link in French), covering 1,200 hectares to be operational by 2027. This is part of the country's third phase of AI development, following previous investments of €1.5 billion (2018-2021) and €1 billion (2022-2024). The government aims to attract international players with decarbonised nuclear energy. Additional initiatives include creating a "Choose France Talent Research" cell to attract researchers, raising public procurement thresholds, and investing €2 million in "AI cafés" for public education.

A few days later, at the AI summit held in France, the United Arab Emirates announced an investment of between €30 billion and €50 billion to create an ‘AI campus’. The package includes the construction of a giant data centre and will also be used to purchase Nvidia chips. Meanwhile, Canadian giant Brookfield has unveiled a plan to invest €20 billion between now and 2030 to develop data centres in France. In all, €109 billion of investment has been announced in the space of two days to make France compete with the US and China on the AI scene.

🔜 Next week’s edition includes a deep dive into the intersection of AI, data centres and life sciences real estate.