Welcome to Edition 40 of our Life Sciences Real Estate newsletter. Following the success of Edition 38's lighter approach, we're settling into our new rhythm of alternating between our customary in-depth analysis and more conversational editions. Don't worry, long-time readers – our comprehensive market coverage isn't going anywhere. We're simply adding variety with these alternate weeks, and we hope you enjoy the new tempo.

Here’s what we cover today:

✅ City life: science at the heart of the city

✅ Industry voice: Daniel Tomaselli at Principal Real Estate

🔒 Railway revolution: the Oxford-Cambridge Arc initiative

🔒 Wordplay: playing with words while building a database

(🔒 items are for paying members only)

Read more below for all the details. Our usual deep dive analysis and list of deals will return on 6 March.

— Stephen Ryan (connect with me on LinkedIn)

Science in the heart of the city

The traditional image of life sciences facilities - sprawling suburban campuses set amid manicured lawns and corporate parking lots - is being challenged by a new wave of urban laboratories that place scientific innovation at the heart of city life. This shift reflects a growing recognition that scientists, like other professionals, often prefer to work in vibrant urban settings rather than isolated locations "in a field somewhere," as one UK-based researcher memorably described it.

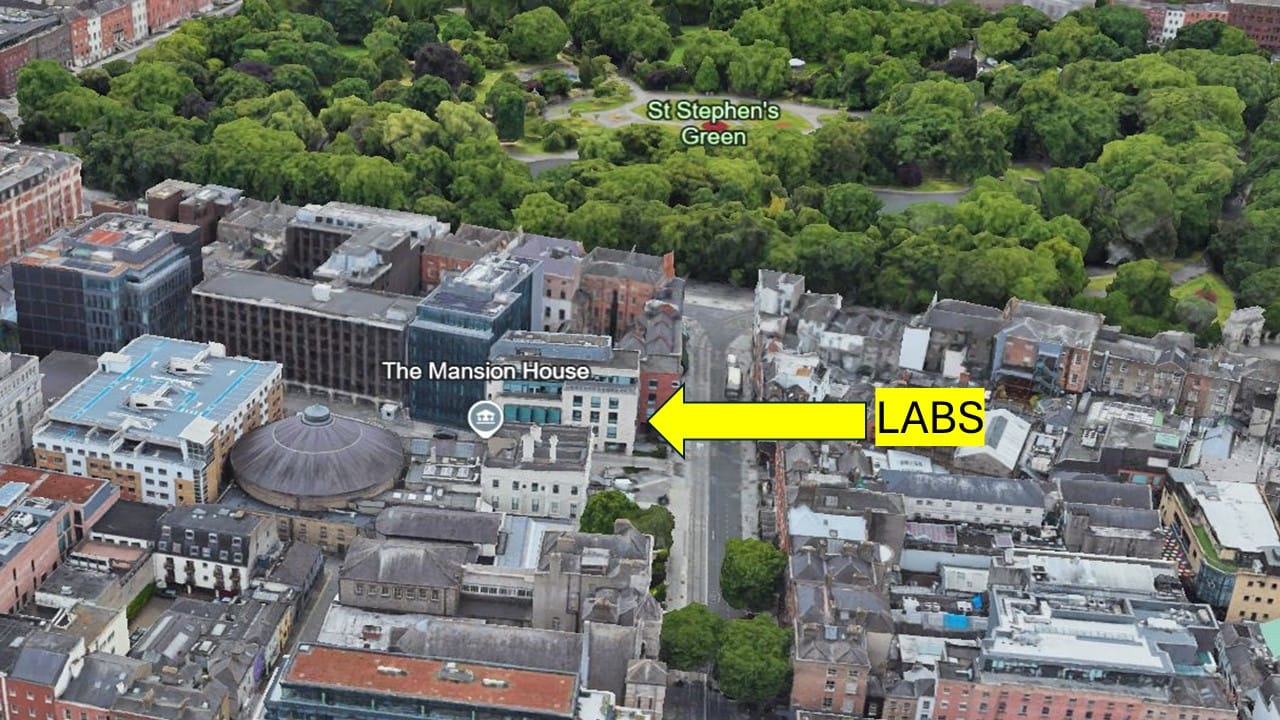

Three notable examples of this trend are emerging in European capitals. In Dublin, biotech company Nuritas has established its headquarters and research facilities in Dawson Street, a stone's throw from St. Stephen's Green and right beside the Mansion House (where the Lord Mayor lives), placing its scientists in one of the city's busiest streets.

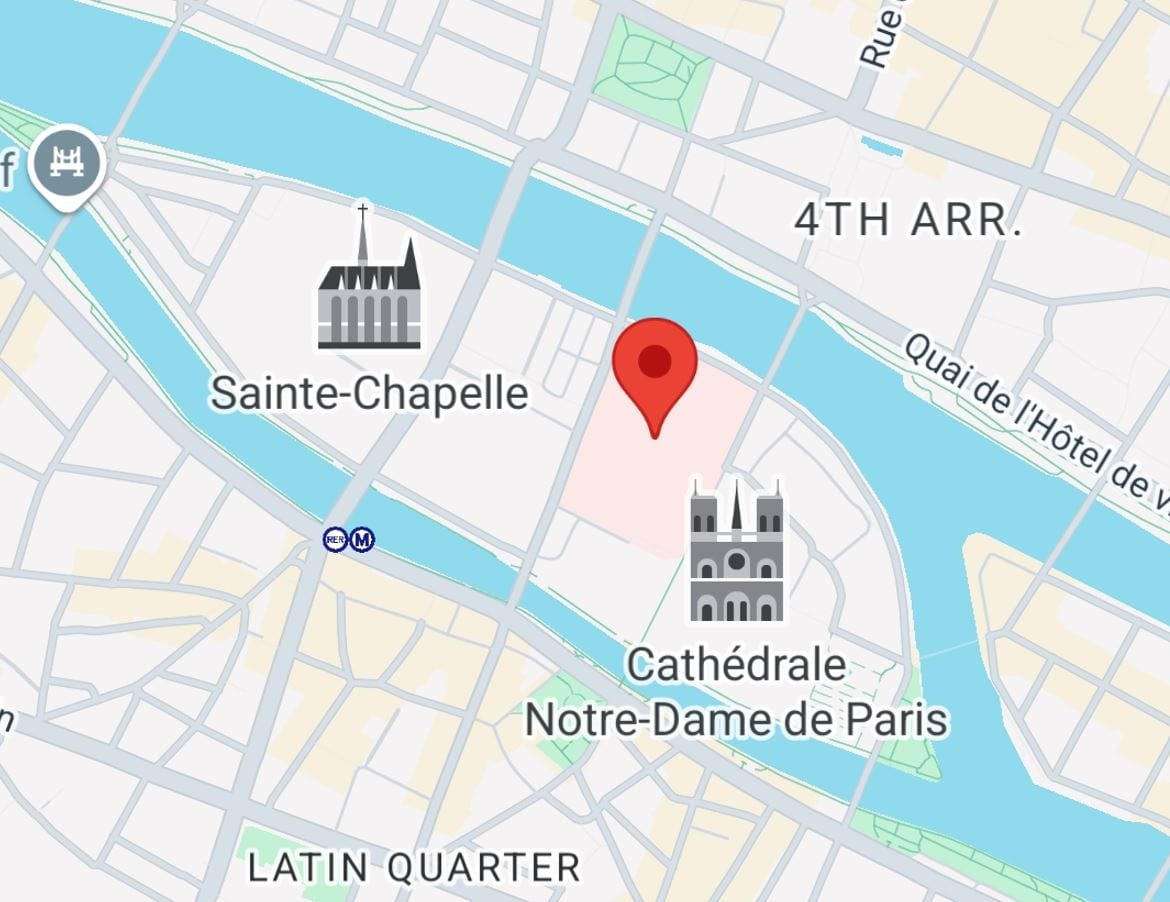

Paris is set to welcome a remarkable new BioLabs facility in the Hôtel-Dieu hospital at 1 Parvis Notre-Dame, Place Jean-Paul II, in the city's 4th arrondissement. The location could hardly be more central - it sits in the shadow of Notre-Dame Cathedral on the Île de la Cité, the historic heart of Paris.

In London, the Crick Institute near King's Cross station represents another prime example of this urban shift. The location capitalises on one of London's most well-connected transport hubs. The location is highly significant: rather than being banished to the outskirts of the city, the building faces St Pancras International Station – one of the main points of arrival into the UK.

This urban approach to life sciences real estate represents more than just a change of address. The traditional science park or business park model, while offering benefits such as purpose-built facilities and room for expansion, can create artificial boundaries between scientific work and city life. Urban laboratories, by contrast, integrate scientific endeavour into the fabric of the city.

These developments challenge the assumption that life sciences facilities must necessarily be isolated due to safety or regulatory requirements. Modern laboratory design and engineering can ensure that urban facilities meet all necessary safety and compliance standards while offering the advantages of city centre locations. Laboratory work and city life need not be mutually exclusive.

📌 983 records – transactions logged across Europe

📌 23 countries – coverage of key life sciences hubs

📌 €56 billion – total investment tracked

📌 22 million sq m – space transacted

It's also easy to sort, filter and search through it. Access the data

Industry voice: Daniel Tomaselli

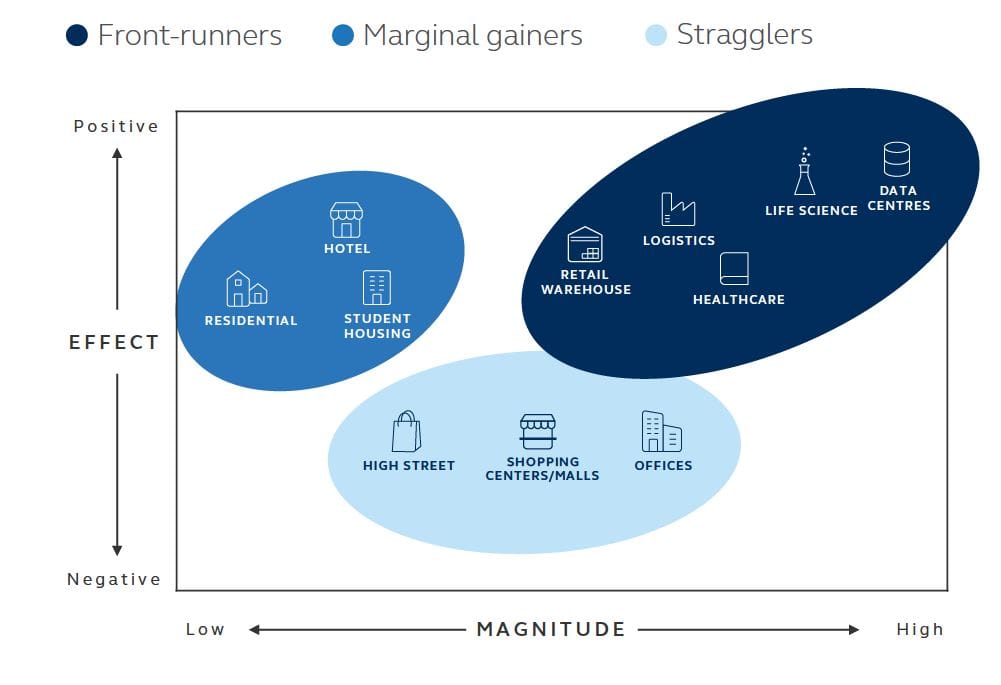

According to Daniel Tomaselli, Manager of Global Real Estate Research at Principal Real Estate, life sciences is one of the "front runner" sectors poised to benefit significantly from AI adoption. In his detailed research paper examining AI's impact on different property sectors, Tomaselli emphasises that while AI will not directly drive demand for life science real estate like it does for data centres, AI advancements are pivotal in accelerating biotech industry growth.

Nvidia, the world's leading AI chipmaker, has announced multiple partnerships with healthcare companies, ranging from imaging, medtech, drug discovery, and digital health, Tomaselli points out.

The traditional drug and molecule discovery process has been lengthy and expensive, often taking 10+ years and billions of dollars to bring solutions to market. AI and deep learning algorithms could reduce R&D time and costs by at least 25-50%, according to the Boston Consulting Group.

Tomaselli suggests a potential shift in space requirements, with wet labs potentially giving way to more AI labs focused on computational research.

🔜 Next week’s edition examines five impressive examples of historic buildings being converted to life sciences usage, plus the usual roundup of deals.