Dear reader,

Welcome to this week’s edition of our life sciences real estate newsletter. We continue to bring you insights weekly, alternating between in-depth market analyses with a full deal list (like last week’s) and lighter industry overviews featuring key voices and trends—always with at least one notable deal woven in. Each format offers a different perspective on the sector, helping you see the bigger picture.

Here's what we cover today:

✅ Schroders: €2.2 billion fund targets life sciences

✅ Industry voice: Hendrik Staiger of BEOS

🔒 Sofinnova: €1.2 billion VC fund will spur demand for space

🔒 London: 25 years of bioinnovation

(🔒 items are for paying members only)

Read more below for all the details. Our usual deep-dive analysis and list of deals will return on 20 March.

— Stephen Ryan (connect with me on LinkedIn)

Schroders bets on life sciences

Schroder ImmoPLUS, a €2.2 billion (£1.8 billion) real estate fund, is significantly expanding its presence in the life sciences sector. Established in 1997, the fund targets commercial properties with value appreciation potential, capitalising on this through active management strategies. The fund is described as suiting investors who seek a diversified portfolio of high-yield properties that generate a sustainable distribution. Roger Hennig has been the manager since 2001.

ImmoPLUS is structured as an investment trust and is listed on the SIX Swiss Exchange in Zurich.

A snapshot of the portfolio

The portfolio comprises 49 commercial properties spread across Switzerland, delivering a 4.3 per cent average net yield.

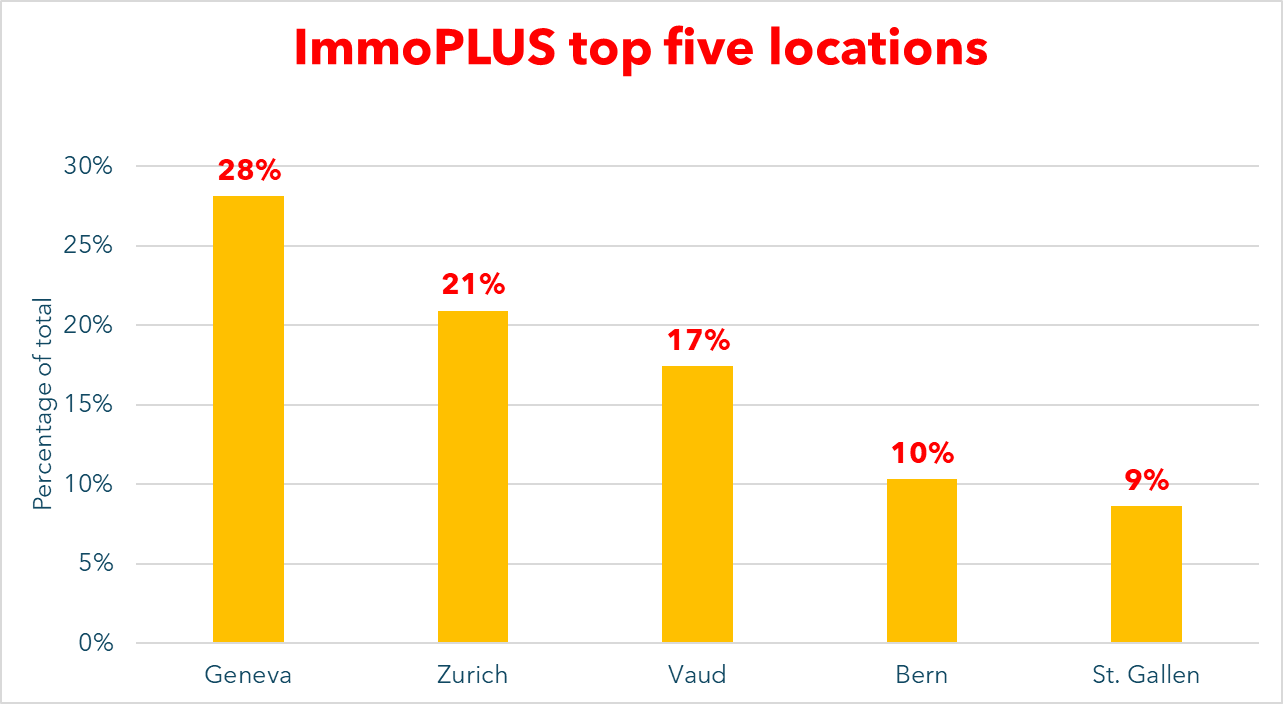

Geographically, the assets are concentrated in key economic centres with Geneva and Zurich together making up almost 50 per cent of total assets.

In terms of sector allocation, office space dominates at 36 per cent of rental income, with retail properties contributing 26 per cent. The life sciences sector currently represents 12 per cent but is set to grow to 17 per cent through acquisitions. Hospitality, residential, logistics and other uses make up the remainder.

UBS Switzerland AG serves as the anchor tenant, generating almost 11 per cent of rental income, while the six largest tenants collectively account for 40 per cent of rental revenue.

Recent deal

The fund expanded its portfolio in Q4 2024 by acquiring a laboratory and office facility in Kemptthal near Winterthur for CHF 165 million (€172 million / £147 million). This single-tenant property delivers a net yield of approximately 4 per cent while extending the fund's average lease duration from 6.6 to 7.8 years. The lease agreement is fully indexed, ensuring long-term rental income security over the 25-year lease term. In Q1 2025, a capital increase was undertaken to partially refinance this acquisition and to fund future opportunities.

With this acquisition, the strategically important life science sector, which generates stable rental income over the long term, will be further expanded to around 17 per cent of total rental income.

Longer leases, stable income

ImmoPLUS is one of many multi-sector funds to take advantage of the longer leases and stable income that life sciences tenants can provide. AEW’s pan-European open-ended fund EUROCORE and Fidelity International's Eurozone Select Real Estate Fund are examples, as is BEOS's Corporate Real Estate Fund Germany IV.

📌 983 records – transactions logged across Europe

📌 23 countries – coverage of key life sciences hubs

📌 €56 billion – total investment tracked

📌 22 million sq m – space transacted

It's also easy to sort, filter and search through it. Access the data

Industry voice: Hendrik Staiger of BEOS

BEOS, the Berlin-based asset manager, has launched a new €800 million special fund as part of its long-standing Corporate Real Estate Fund Germany (CREFG) series, with life sciences forming a key growth area within its broader "Four Ls" strategy, according to management board spokesperson Hendrik Staiger.

The four Ls

In a Q4 2024 interview with Green Street News, Staiger outlines the firm’s strategic focus on living, light industrial, logistics, and life sciences—sectors performing well relative to other asset classes. He notes that while some life sciences users can be accommodated in existing commercial spaces, those requiring specialised GMP production areas need purpose-built solutions in established clusters.

The firm remains bullish on residential while staying cautious about office, retail, and hotel assets. The new fund, which is the fifth one in their CREFG series, targets a 5 per cent yield.

"We believe that satisfied tenants ultimately also mean satisfied investors," Staiger emphasises, as BEOS continues developing 270,000 sq m of new space.

🔜 Next week’s edition examines the property portfolios of large pharma companies, plus the usual roundup of deals.