Dear reader,

Welcome to this week’s edition. Our weekly newsletter alternates between two formats: comprehensive market analyses with deal listings, and more conversational industry insights featuring key voices and trends. These complementary formats provide varied perspectives, helping you stay fully informed. Today's edition is of the more conversational type.

Here is what we cover:

✅ US index: NCREIF's ODCE index integrates life sciences

✅ Industry voice: Ellie Junod of UBS

🔒 Spain: JLL Spain backs alternatives

🔒 Bees and hives: the perfect biotech metaphor

(🔒 items are for paying members only)

Read more below for all the details. Our usual deep-dive analysis and list of deals will return on 3 April.

— Stephen Ryan (connect with me on LinkedIn)

US real estate index integrates life sciences and alternative property types

Introduction to ODCE

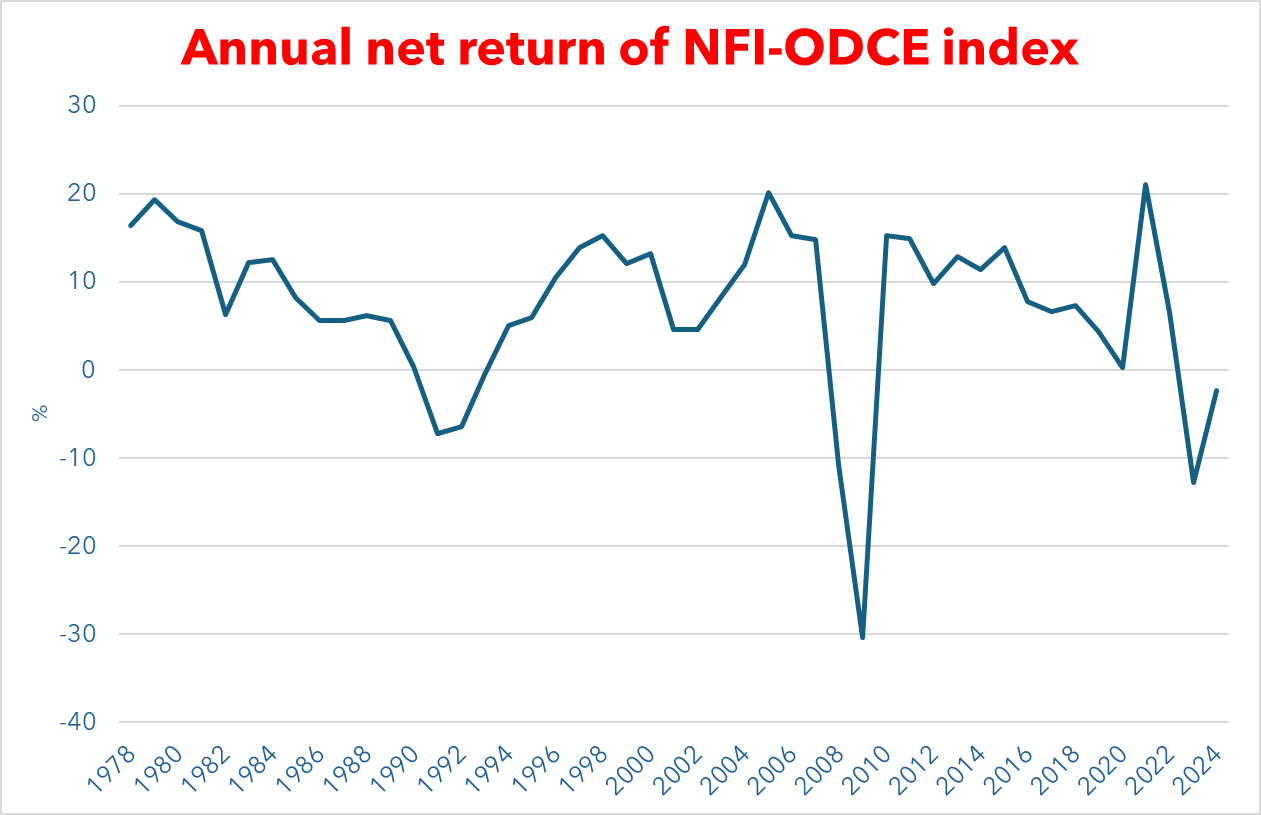

The NCREIF Fund Index - Open End Diversified Core Equity (NFI-ODCE), often called Odyssey, is a capitalisation-weighted, time-weighted return index. It captures investment returns from leading private real estate funds that adopt conservative investment strategies with minimal leverage. These funds primarily invest in stable, income-generating US properties spread across key sectors such as office, industrial, residential and retail, diversified geographically.

Why investors use the NFI-ODCE Index

Benchmarking: the index is widely used by institutional investors, including pension funds, as a primary benchmark for assessing the performance of their private real estate holdings.

Market insights: ODCE provides essential market intelligence, highlighting trends and enabling investors to make informed decisions about commercial real estate opportunities.

Fundraising: being part of the NFI-ODCE index can significantly enhance a fund's visibility and credibility, attracting institutional investment.

Strategic shift towards alternative property types

In a strategic move, ODCE funds are increasingly embracing alternative property types, with the flexibility to allocate up to 25 per cent of their portfolios to these emerging sectors. Life sciences properties, which previously lacked clear categorisation, are now assigned to industrial or office subtypes based on their unique characteristics.

Asset allocation and diversification opportunities

This evolution in the ODCE framework has significant implications for investors and fund managers:

Enhanced diversification: introducing life sciences and other alternative sectors provides investors exposure to property types with lower correlation to traditional sectors, enhancing overall portfolio diversification.

Greater portfolio flexibility: fund managers now have more scope to construct diversified portfolios, integrating alternative assets like life sciences properties while maintaining the traditional risk profile associated with ODCE funds.

Sector-specific tailwinds: the life sciences sector benefits from structural demographic shifts and ongoing healthcare innovation, offering stability that can mitigate risks during economic fluctuations (further explored in the Industry Voices segment below).

Benchmark evolution: with the integration of alternative sectors, the ODCE index itself is evolving, potentially providing investors with improved benchmarking capabilities and more relevant performance measurement tools.

For investors seeking diversified exposure to real estate, these developments make ODCE funds increasingly attractive. Investors can now efficiently access a wider range of property types, including life sciences, through a single investment vehicle without compromising the core, low-risk profile that has traditionally made these funds appealing.

European equivalents to NFI-ODCE

Investors active in Europe may find comparable tools in MSCI’s PEPFI and INREV’s ODCE Index. INREV’s index recognises four primary sectors—industrial/logistics, office, residential, and retail—with life sciences categorised as an office sub-sector. MSCI’s one similarly covers these four sectors, adding hotels as a fifth category, but it does not currently recognise life sciences as a distinct sub-sector.

📌 983 records – transactions logged across Europe

📌 23 countries – coverage of key life sciences hubs

📌 €56 billion – total investment tracked

📌 22 million sq m – space transacted

It's also easy to sort, filter and search through it. Access the data

Industry voice: Ellie Junod of UBS

Ellie Junod is an Associate Director, Direct Real Estate Investment at UBS. She works solely on life sciences, supporting the execution of transactions, delivery of developments and asset management. Ellie recently participated in a panel discussion at MIPIM 2025 where she noted that life sciences real estate has been "resilient but not immune" to macroeconomic challenges.

Resilience is a word often used in connection with life sciences real estate and the term featured heavily in a series of interviews we conducted in 2023 with Martina La Vista of Lendlease, Rob Beacroft of Lateral, Roger Madelin of British Land, Toğrul Gönden of DRIVEN Investment, Artem Korolev of Mission Street, and George Fraser-Harding of Aviva Investors.

🔜 Next week’s edition examines the property portfolios of contract research organisations (CROs) and contract development and manufacturing organisations (CDMOs), plus the usual roundup of deals.