Dear reader,

In this issue, we head to Île-de-France, where Paris and its surrounding areas are rapidly transforming into one of Europe’s most dynamic life sciences hubs. We also take a look westward, to Ireland’s medtech heartland—where mythology and modern medical devices somehow share the same landscape.

Here's what you'll find in this issue:

✅ Île-de-France: growing its life sciences footprint

✅ Ireland's west coast: 4,000 years of medtech

🔒 Industry voice: Dominic Smith of CBRE

🔒 The 'Discovery' hubs: trends in place names

(🔒 items are for paying members only)

Read more below for all the details. Our usual deep-dive analysis and list of deals will return on 1 May.

— Stephen Ryan (connect with me on LinkedIn)

Life sciences real estate in Île-de-France

The Île-de-France region is undergoing a substantial transformation in its life sciences real estate landscape. Historically constrained by a marked undersupply—particularly affecting small and mid-sized biotechnology firms with laboratory requirements—the market is now entering a new phase of expansion, supported by both public policy and private-sector initiatives.

The current supply of purpose-built life sciences space, including laboratories, associated offices and shared facilities, remains modest relative to demand. Estimates suggest that available surface area falls short of accommodating the region’s growing ecosystem of research-driven enterprises. While exact figures vary depending on methodology, planned developments indicate that total inventory will increase significantly over the next two to three years. The percentage rise is expected to be substantial, potentially more than doubling existing capacity by the end of 2026, with continued expansion anticipated through 2030.

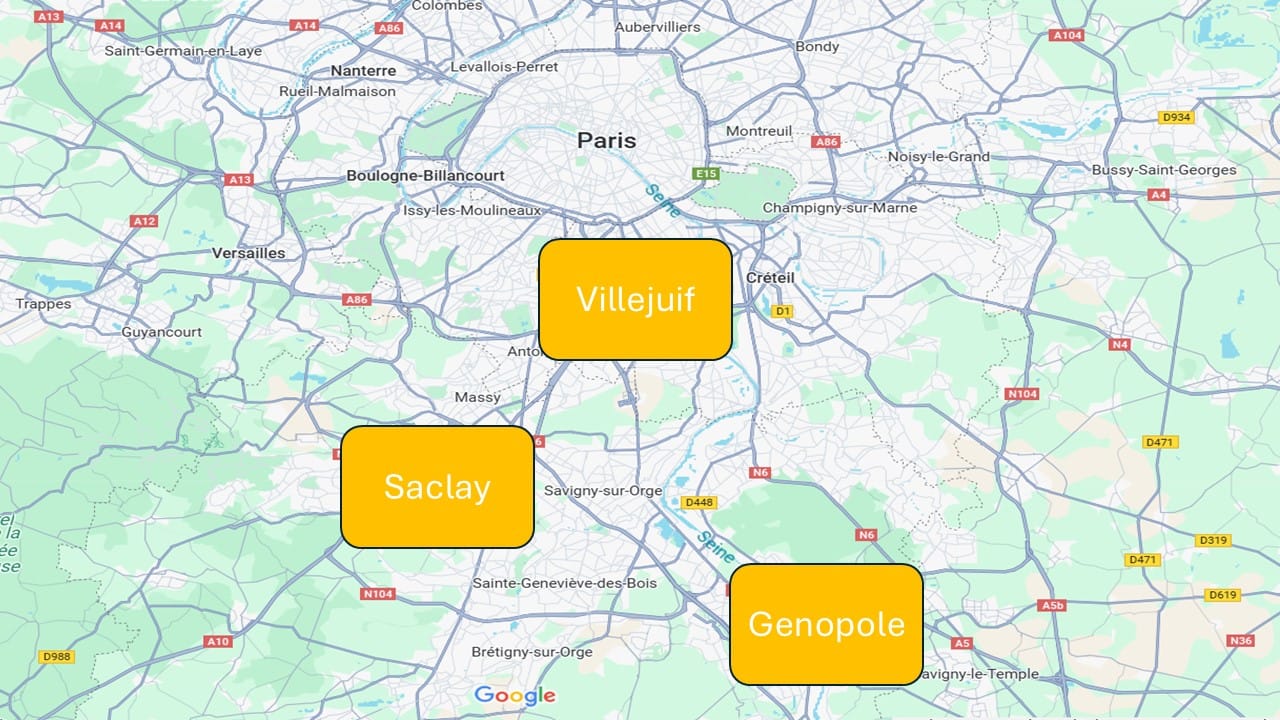

Life sciences activity is particularly concentrated in four major zones: the Saclay R&D hub (southwest of Paris), Villejuif/PSCC (southern Paris), Genopole in Évry-Courcouronnes (southeast of Paris), and central Paris. These locations benefit from proximity to hospital infrastructure, research institutions and specialised equipment.

Alongside this spatial strategy, there has been a marked increase in public and private investment. At the national level, the French government has committed €7.5 billion (£6.5 billion) through its Health Innovation Plan 2030, reinforcing the long-term competitiveness of the Paris region as a hub for healthcare innovation. At the regional level, organisations such as the Île-de-France authority and social landlords like SEM RIVP are supporting development through funding schemes and regulated-rent models for science-focused tenants. Hospital and university sites are also increasingly opening up to external occupants, facilitating new forms of co-location and knowledge transfer.

Private sector engagement is equally dynamic. International life sciences specialists such as Kadans, Patriarche and Biolabs are targeting the region, bringing expertise from clusters in North America and elsewhere in Europe. Meanwhile, local actors are leading in adaptive reuse and niche deployments. DocCity has converted legacy office stock—such as the former Saint-Gobain building in Suresnes—into spaces combining outpatient healthcare and R&D functions. Similarly, Enalees, a veterinary diagnostics firm, has established a new proteomics laboratory at Genopole with regional financial support.

Despite these positive developments, the market continues to face structural challenges. Many prospective occupiers are young companies with limited financial resources but high technical requirements, leading to elevated management costs and subdued returns relative to traditional commercial real estate. In this context, market education remains essential, particularly around the total cost of occupation and the flexibility required for early-stage firms navigating rapid growth.

Close monitoring is needed to balance supply and demand. After addressing undersupply, some warn of potential overcorrection, though absorption rates remain key. Environmental factors—carbon emissions, biodiversity, and sprawl constraints—will increasingly drive commercial building repurposing.

As Île-de-France consolidates its role in the global life sciences ecosystem, collaboration between public authorities, institutional investors, developers and occupiers will be critical to ensuring a balanced, sustainable and resilient real estate offer.

Ireland: ancient to modern medtech

Four millennia before the first coronary stent was made, a legendary Irish king named Nuada famously found himself in urgent need of advanced medical intervention. In a fierce summer solstice battle in Ireland’s west around 1900 BCE, Nuada lost an arm, a setback that could have spelled career disaster for any warrior king. Fortunately, Dian Cécht, the god of healing, and Creidhne, an exceptionally skilled metalworker, collaborated on perhaps history’s earliest successful prosthetic limb—a silver arm said to mimic natural movement perfectly.

Fast forward to today, and the western counties of Galway and Mayo—where Nuada once battled valiantly—are now renowned centres of medical technology innovation. Companies like Medtronic, Boston Scientific, Abbott, and Johnson & Johnson have turned this region into a global powerhouse for lifesaving medical devices. Ireland currently manufactures a staggering 80 per cent of the world’s coronary stents, devices even Nuada might envy for their precision and sophistication.

From Creidhne’s mythical workshop to Boston Scientific’s €100 million (£86 million) Galway campus, Ireland’s west coast has proven remarkably consistent in producing world-class solutions to pressing medical problems. That today's surgeons use devices developed in the same region where tales of Nuada's silver arm originated highlights a remarkable continuity between Ireland's mythological past and its medical technology present.

📌 1,091 transactions tracked across Europe

📌 24 countries

📌 €60 billion in total investment value

📌 24 million sq m of real estate

It's also easy to sort, filter and search through it. Access the data

🔜 Next week's article will explore UK life sciences real estate in the context of the overall UK market.