In today’s highly competitive and regulated environment, pharmaceutical companies face significant pressure to optimise all aspects of their operations, including the management of their extensive real estate portfolios. With properties ranging from manufacturing plants and laboratories to warehouses and office spaces, these companies hold a vast and varied array of real estate assets. To leverage these assets most effectively, two strategies emerge as particularly crucial: continual management of the existing real estate portfolio and unlocking capital through sale and leaseback (S&LB) transactions.

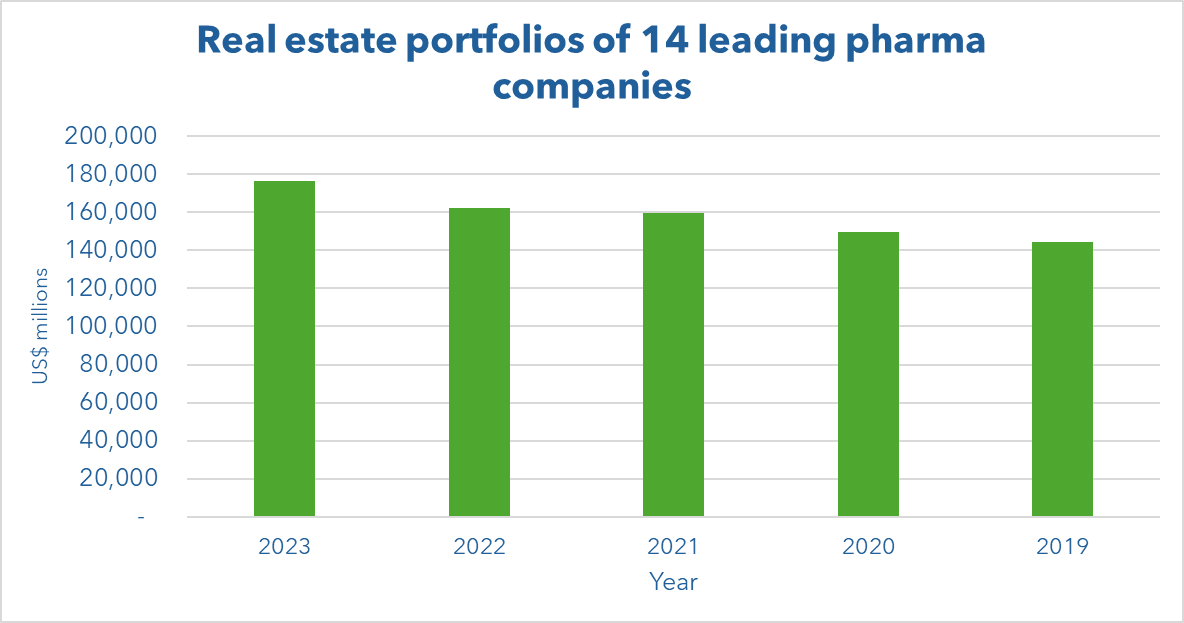

Our analysis covers the real estate portfolios of 14 leading pharmaceutical companies and draws on our proprietary dataset of 656 deals, which are categorised by date, country, city, size, value, deal type, building type, and dealmaker. The combined real estate holdings of these companies exceed $175 billion, surpassing the total real estate assets of three major insurance groups - Allianz, AXA, and Zurich - according to IPE Real Assets' ranking of the world’s top 150 real estate investors. If Roche were a real estate investor, it would be ranked no.22 in the world.